Private Equity Market Size, Share, Analysis And Trends Report | 2025-2033

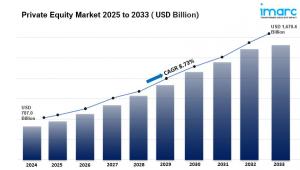

The global private equity market size to reach USD 1,670.43 Billion by 2033, exhibiting a CAGR of 8.73% from 2025-2033.

NEW YORK, NY, UNITED STATES, July 9, 2025 /EINPresswire.com/ -- Overview of the Private Equity Market:The private equity market refers to investments made in private companies or public companies with the intent of taking them private. This market plays a crucial role in financing and transforming businesses by providing capital for growth, restructuring, or expansion. Private equity firms typically raise funds from institutional investors and high-net-worth individuals to invest in various sectors, aiming for high returns over a medium to long-term horizon.

The global private equity market size reached USD 787.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1,670.4 Billion by 2033, exhibiting a growth rate (CAGR) of 8.73% during 2025-2033. The increased investor appetite for alternative investments, low-interest rates encouraging leverage, the pursuit of higher returns amidst market volatility, and a favorable regulatory environment fostering investment opportunities are some of the key factors explained in the market research.

Request to Get the Sample Report: https://www.imarcgroup.com/private-equity-market/requestsample

Key Highlights:

Market Growth:

The private equity market has experienced significant growth, with global assets under management (AUM) reaching record levels, surpassing $4 trillion.

Increased fundraising activities and a robust deal-making environment have contributed to this expansion.

Diverse Investment Strategies:

Private equity firms employ various strategies, including buyouts, venture capital, growth equity, and distressed asset investing.

Each strategy targets different stages of a company's lifecycle, from startups to mature enterprises.

Sector Focus:

Key sectors attracting private equity investment include technology, healthcare, consumer goods, financial services, and renewable energy.

The technology sector, particularly software and fintech, has seen a surge in investment due to digital transformation trends.

Geographical Insights:

North America remains the largest market for private equity, driven by a strong economy and a mature investment landscape.

Europe and Asia-Pacific are also significant players, with increasing deal activity and growing interest from institutional investors.

Regulatory Environment:

Regulatory changes and scrutiny have impacted private equity operations, particularly regarding transparency and reporting requirements.

Firms are adapting to these changes while continuing to seek attractive investment opportunities.

Exit Strategies:

The private equity exit landscape has evolved, with initial public offerings (IPOs), secondary buyouts, and strategic sales being common exit routes.

A favorable market environment has led to increased exit activity, allowing firms to realize returns on their investments.

Trends in the Private Equity Market

Increased Focus on ESG:

Environmental, Social, and Governance (ESG) considerations are becoming integral to investment strategies, with firms prioritizing sustainable and socially responsible investments.

Investors are demanding greater transparency regarding ESG practices and performance.

Technological Integration:

Private equity firms are leveraging technology for due diligence, portfolio management, and operational improvements.

Data analytics and artificial intelligence are being used to enhance decision-making processes and identify investment opportunities.

Rise of Secondary Markets:

The growth of secondary markets for private equity interests is providing liquidity options for investors, allowing them to buy and sell stakes in funds.

This trend is enhancing market efficiency and attracting new investors.

Co-Investment Opportunities:

Co-investment opportunities are becoming increasingly popular, allowing limited partners to invest alongside private equity firms in specific deals.

This trend provides investors with greater control and potential for higher returns.

Globalization of Investment:

Private equity firms are expanding their reach into emerging markets, seeking growth opportunities in regions with untapped potential.

Cross-border investments are becoming more common as firms look to diversify their portfolios.

Buy Now: https://www.imarcgroup.com/checkout?id=8078&method=1670

Private Equity Market Report Segmentation:

By Fund Type:

Buyout

Venture Capital (VCs)

Real Estate

Infrastructure

Others

Buyout holds the majority of the market share because buyout funds focus on acquiring and restructuring underperforming companies, providing opportunities for significant value creation and high returns.

Regional Insights:

North America

Asia-Pacific

Europe

Latin America

Middle East and Africa

North America's dominance in the market is attributed to its mature financial ecosystem, robust economic growth, and a high concentration of institutional investors and private equity firms.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=8078&flag=C

Key Companies:

AHAM Asset Management Berhad

Allens

Apollo Global Management, Inc.

Bain and Co. Inc.

Bank of America Corp.

BDO Australia

Blackstone Inc.

CVC Capital Partners

Ernst and Young Global Ltd.

HSBC Holdings Plc

Morgan Stanley

The Carlyle Group

Warburg Pincus LLC

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Related Posts:

Software Defined Anything Market: https://www.imarcgroup.com/software-defined-anything-market/requestsample

Elena Anderson

IMARC Services Private Limited

+1 631-791-1145

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.