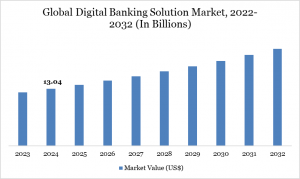

Digital Banking Solution Market to Reach $24.96 Bn by 2032 | DataM Intelligence

Global Digital Banking Solution Market grew to $13.04 Bn in 2024 and is set to hit $24.96 Bn by 2032 at 8.62% CAGR, driven by fintech adoption.

NEW YORK, NY, UNITED STATES, September 3, 2025 /EINPresswire.com/ -- The global digital banking solution market is projected to grow robustly from USD 13.04 billion in 2024 to USD 24.96 billion by 2032, at a compound annual growth rate (CAGR) of 8.62%. This growth is fueled by the swift adoption of online and mobile banking platforms, along with regulatory mandates driving digital transformation in the banking sector. Increasing smartphone penetration, changing consumer behavior favoring convenience, and emerging technologies such as artificial intelligence (AI), blockchain, and cloud computing are redefining financial services worldwide.Digital banking solutions enable banks and financial institutions to offer seamless, secure, and personalized services across channels, including mobile applications, web portals, and automated customer interactions. The transition from traditional branch banking to omnichannel digital experiences is accelerating, driven by shifting customer expectations and competitive pressures.

Get a Report Sample of Digital Banking Solution Market @ https://www.datamintelligence.com/download-sample/digital-banking-solution-market

Latest Strategic Developments (2024-2025)

• Strategic acquisitions: In 2025, Computer Services, Inc. (CSI) acquired Apiture, enhancing its portfolio with a robust digital banking platform tailored for U.S. financial institutions.

• Product launches and partnerships: Finastra collaborated with Qatar's Al Rayan Bank to launch advanced corporate digital banking services, demonstrating the market’s growing complexity and tailored offerings.

• Cloud adoption: Financial institutions increasingly adopt cloud-based infrastructures for flexibility and scalability, propelled by regulatory encouragement and cost imperatives.

• Regulatory compliance: Implementation of PSD2, GDPR, and other regional regulations enforces stricter security and operational standards, influencing solution innovation and adoption.

United States: Recent Industry Developments

✅ In July 2025, JPMorgan Chase launched an AI-powered digital banking solution for small businesses. The platform streamlines payments, invoicing, and lending services. It aims to enhance financial accessibility for entrepreneurs.

✅ In June 2025, Bank of America invested $400 million to expand its mobile-first banking ecosystem. The upgrade integrates biometric security and real-time financial advice. It reflects the rising demand for personalized digital experiences.

✅ In May 2025, Wells Fargo partnered with fintech startup Plaid to roll out an open banking solution. The integration enables secure customer data sharing. It supports the growth of third-party financial applications in the U.S.

Japan: Recent Industry Developments

✅ In July 2025, Mitsubishi UFJ Financial Group (MUFG) launched a next-gen digital-only banking service. The platform leverages AI for personalized wealth management. It targets Japan’s younger and tech-savvy population.

✅ In June 2025, Sumitomo Mitsui Banking Corporation (SMBC) invested in blockchain-based digital banking solutions. The initiative enhances transaction transparency and security. Pilot use cases include trade finance and cross-border payments.

✅ In May 2025, Rakuten Bank introduced a super-app integrating banking, e-commerce, and payments. The solution strengthens customer engagement. It positions Rakuten as a leader in Japan’s digital finance ecosystem.

Market Dynamics

Drivers: Rising customer demand for personalized, 24/7 banking services, coupled with regulatory pressures to enhance cybersecurity and data privacy, propels digital banking solution adoption. Innovations like AI-driven fraud detection and blockchain-based transaction security address key operational challenges while improving user trust.

Restraints: Legacy banking systems pose integration challenges, and high implementation costs restrain smaller institutions. Ongoing compliance with evolving regulations increases operational complexity.

Opportunities: Expanding financial inclusion in emerging markets, driven by mobile banking and digital wallets, presents vast growth potential. Integration of API-driven open banking platforms fosters innovation through third-party collaborations.

Challenges: Ensuring seamless customer experiences amid back-end modernization, managing cybersecurity risks, and overcoming cultural and infrastructural barriers in less developed regions.

Market Segmentation

• Component & Deployment: Software leads the market, enabling automation, real-time analytics, and customer engagement, with cloud deployment growing rapidly due to scalability and cost benefits.

• Industry Vertical: BFSI dominates adoption, driven by demands for risk mitigation, compliance, and customer service optimization.

• Mode: Mobile app-based solutions are increasingly prevalent, aligning with consumer device preferences and advancing payment technologies.

Regional Insights

• Asia-Pacific: The fastest-growing region, benefitting from rising digital literacy, smartphone proliferation, government initiatives like India’s Digital India and UPI, and technologically advanced markets like Japan, South Korea, and Singapore.

• North America: Holds the largest market share with mature digital banking ecosystems, robust infrastructure, and significant R&D investments by tech giants.

• Europe: Characterized by stringent regulation driving security and innovation, with growing open banking adoption.

Looking for in-depth insights? Grab the full report: https://www.datamintelligence.com/buy-now-page?report=digital-banking-solution-market

Competitive Landscape

Leading players include Adobe, OpenText, Temenos, Fiserv, FIS, Capgemini, IBM, and Oracle. These companies focus on product innovation, strategic collaborations, and geographic expansion to seize market opportunities.

Conclusion

The digital banking solution market is fundamental to the transformation of global finance, empowering institutions to meet evolving customer demands with agility and security. As technology continues to advance and regulatory landscapes evolve, the market is poised for sustained growth, driven by innovation and expanding digital financial inclusion

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights-all in one place.

Competitive Landscape

Sustainability Impact Analysis

KOL / Stakeholder Insights

Unmet Needs & Positioning, Pricing & Market Access Snapshots

Market Volatility & Emerging Risks Analysis

Quarterly Industry Report Updated

Live Market & Pricing Trends

Consumer Behavior & Demand Analysis

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Related Reports:

Open Banking Market reached US$ 20.9 billion in 2022 and is expected to reach US$ 129.8 billion by 2030, growing with a CAGR of 25.7% during the forecast period 2023-2030.

Global neobanking market will grow at a high CAGR of 49.2% during the forecast period 2024- 2031.

Sai Kumar

DataM Intelligence 4market Research LLP

+1 877-441-4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.