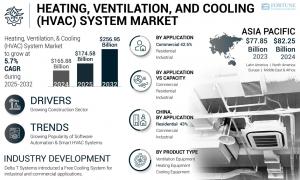

HVAC Systems Market Analysis: 5.7% CAGR Drives USD 256.95 Billion Projection by 2032

HVAC market analysis: USD 256.95B by 2032 at 5.7% CAGR. Asia Pacific leads with 49.58% share. Commercial applications drive 44% of demand.

Asia Pacific dominates HVAC market with 49.58% share in 2024, driven by infrastructure investment and climate adaptation across residential and commercial sectors.”

PUNE, MAHARASHTRA, INDIA, October 7, 2025 /EINPresswire.com/ -- The global HVAC systems market is tracking a solid growth trajectory, with projections showing expansion from USD 174.58 billion in 2025 to USD 256.95 billion by 2032 at a CAGR of 5.7%. This growth reflects fundamental shifts in construction practices, energy efficiency mandates, and climate adaptation strategies across commercial and residential sectors.— Fortune Business Insights

What's driving this expansion? The convergence of urbanization, regulatory pressure for energy efficiency, and increasing investment in smart building infrastructure is creating sustained demand across all major geographies.

HVAC Market Snapshot

2024 Market Size: USD 165.88 billion

2025 Market Size: USD 174.58 billion

2032 Projected Value: USD 256.95 billion

CAGR (2025-2032): 5.7%

Leading Region: Asia Pacific (49.58% market share in 2024)

Dominant Application: Commercial segment (44% share in 2023)

Key Product Category: Heating equipment (over 50% revenue share)

Major Players: Johnson Controls, Daikin Industries, Carrier, Mitsubishi Electric, LG Electronics

Get a Free Sample Research PDF:https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/102664

HVAC Market Size

The HVAC market size was valued at USD 165.88 billion in 2024 and reached USD 174.58 billion in 2025. By 2032, the market is projected to hit USD 256.95 billion, reflecting consistent demand from construction, infrastructure development, and retrofit projects across residential, commercial, and industrial applications.

Historical growth patterns show steady adoption driven by infrastructure expansion in developing economies and replacement cycles in mature markets. The projected growth through 2032 indicates sustained capital investment in climate-controlled environments and regulatory momentum toward energy-efficient systems.

HVAC Market Share

The HVAC market share accounted for significant contributions from heating equipment, which commands over 50% of total revenue across product categories. Geographically, Asia Pacific holds the dominant position with 49.58% market share in 2024, followed by North America and Europe as major consumption centers.

Within applications, the commercial segment captured approximately 44% of total market share in 2023, driven by office buildings, retail complexes, and hospitality infrastructure. The heating equipment segment leads product categories due to diverse climate requirements and ongoing adoption of decentralized heating solutions with intelligent controls.

HVAC Market Growth

The HVAC market growth is driven by expanding construction activity, government incentives for energy efficiency, and increasing adoption of smart building technologies. The 5.7% CAGR reflects multiple growth vectors: rising residential sales (617,000 units recorded in June 2024 according to U.S. Census Bureau data), commercial property development, and industrial facility upgrades.

Key growth catalysts include poor air quality concerns driving ventilation system adoption, climate change necessitating adaptive cooling solutions, and green building certifications like LEED pushing energy-efficient installations. According to U.S. Department of Energy data, HVAC equipment accounts for approximately 40% of total energy consumption in commercial buildings, making efficiency improvements a priority for property owners.

Competitive Landscape

The market features both global manufacturers and regional players competing on technology, energy efficiency, and service capabilities. Johnson Controls (Ireland) and Daikin Industries (Japan) maintain strong positions through extensive distribution networks and R&D investment. Carrier (U.S.) and Trane Technologies (Ireland) leverage brand recognition in commercial applications.

Asian manufacturers including Mitsubishi Electric Corporation (Japan), LG Electronics (South Korea), and Samsung (South Korea) are expanding through product innovation and competitive pricing. Lennox International (U.S.), Nortek Global HVAC, and Emerson Electric Co. (U.S.) round out the competitive field with specialized product portfolios.

Strategic approaches focus on launching energy-efficient models, integrating smart controls and IoT connectivity, and forming technology partnerships to deliver complete building automation solutions.

Market Dynamics

Drivers: Construction sector expansion in developing economies, government regulatory standards for energy efficiency, urbanization trends, rising disposable income, climate adaptation requirements, and smart home technology adoption all propel market growth.

Restraints: High installation costs for energy-efficient systems, significant initial capital investment requirements, limited skilled workforce for advanced system installation and maintenance, and adoption challenges in small and medium-scale businesses constrain market expansion.

Opportunities: Software automation integration, building management system connectivity, ductless system adoption in space-constrained properties, retrofit projects in aging infrastructure, and growing demand for air purification technologies present expansion opportunities.

Challenges: Post-pandemic supply chain disruptions, raw material availability constraints, cross-border trade tensions, emerging technologies requiring workforce upskilling, and varying regional regulatory standards create operational complexities.

Connect with Our Expert for any Queries: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/102664

Segmentation

By Product Type: Heating equipment (heat pumps, furnaces, boilers, unitary heaters) dominates with over 50% revenue share. Cooling equipment includes unitary air conditioners, VRF systems, chillers, room air conditioners, coolers, and cooling towers. Ventilation equipment comprises air-handling units, air filters, dehumidifiers, air purifiers, ventilation fans, and humidifiers.

By Application vs Capacity: Commercial segment leads with 44% market share in 2023, categorized by capacity (up to 10 tons, 10 to 25 tons, above 25 tons). Residential applications split into up to 2 tons and 2 to 5 tons capacity ranges. Industrial segment divides into 25 to 50 tons, 50 to 120 tons, and above 120 tons.

By End Application: Commercial applications lead due to office buildings, retail complexes, and hospitality properties. Residential segment shows strong growth from multistoried buildings and climate control preferences. Industrial applications serve manufacturing facilities and data centers requiring precise environmental control.

Regional Analysis

Regionally, the HVAC market is segmented into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa, with distinct growth patterns shaped by construction activity, climate conditions, and regulatory environments.

Asia Pacific commands 49.58% market share in 2024, driven by infrastructure investment in India and ASEAN countries, manufacturing facility expansion, and rising purchasing power. Real estate development and varying climate conditions sustain robust demand.

North America captures the second-largest market share, with the U.S. market projected to reach USD 62.03 billion by 2032. Extreme climatic conditions, high disposable income, and technological advancement support adoption.

Europe shows steady growth through construction expenditures, residential development, and regulatory policies favoring eco-friendly refrigerants and energy-efficient solutions.

Middle East & Africa experiences growth through real estate expansion in arid regions, with government initiatives supporting energy-efficient system adoption. Latin America maintains steady growth across diverse industrial applications.

Read More Research Reports:

Cooling Towers Market size, share, overview analysis

HVAC Drive Market size, share, overview analysis

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.